- / HOME

| in EUR thousands | Note | 2021 | 2020 |

| Revenues | 3 | 428.954 | 269.247 |

| Cost of sales | 247.475 | 160.960 | |

| Gross profit | 181.479 | 108.287 | |

| Selling expenses | 10.005 | 9.723 | |

| General administration expenses | 25.382 | 17.950 | |

| Research and development costs | 4 | 56.809 | 58.379 |

| Other operating income | 5 | 11.469 | 14.536 |

| Other operating expenses | 6 | 1.774 | 1.941 |

| Operating expenses | 82.501 | 73.457 | |

| Operating result | 98.978 | 34.830 | |

| Finance income | 232 | 348 | |

| Finance expense | 279 | 104 | |

| Net finance income | 8 | -47 | 244 |

| Profit before taxes | 98.931 | 35.074 | |

| Taxes on income | 9 | 4.092 | 604 |

| Profit for the year | 94.839 | 34.470 | |

| Attributable to: | |||

| Owners of AIXTRON SE | 95.660 | 34.879 | |

| Non-controlling interests | -821 | -409 | |

| Basic earnings or loss per share (EUR) | 20 | 0,85 | 0,31 |

| Diluted earnings or loss per share (EUR) | 20 | 0,85 | 0,31 |

See accompanying notes to consolidated financial statements.

| in EUR thousands | Note | 2021 | 2020 |

| Net income | 94.839 | 34.470 | |

| Items that will not be reclassified subsequently to profit or loss (after taxes): |

|||

| Remeasurement of defined benefit obligation | 112 | -21 | |

| Items that may be subsequently reclassified to profit or loss (after taxes): | |||

| Currency translation adjustment | 19 | 4.487 | -3.344 |

| Other comprehensive income/loss | 4.599 | -3.365 | |

| Total comprehensive income for the year | 99.438 | 31.105 | |

| Attributable to: | |||

| Owners of AIXTRON SE | 100.257 | 31.535 | |

| Non-controlling interests | -819 | -430 |

See accompanying notes to consolidated financial statements.

| in EUR thousands | Note | 31.12.21 | 31.12.20 |

| Assets | |||

| Property, plant and equipment, and leased assets | 11 | 74.013 | 63.469 |

| Goodwill | 12 | 72.319 | 70.977 |

| Other intangible assets | 12 | 2.246 | 2.876 |

| Other non-current financial assets | 13 | 703 | 60.497 |

| Deferred tax assets | 14 | 24.735 | 14.415 |

| Total non-current assets | 174.016 | 212.234 | |

| Inventories | 15 | 120.629 | 79.087 |

| Trade receivables | 16 | 80.962 | 41.304 |

| Current tax receivables | 10 | 2.363 | 949 |

| Other current assets | 16 | 10.238 | 7.171 |

| Other financial assets | 17 | 201.625 | 62.422 |

| Cash and cash equivalents | 18 | 150.863 | 187.259 |

| Total current assets | 566.680 | 378.192 | |

| Total assets | 740.696 | 590.426 | |

| Liabilities and equity | |||

| Share capital | 19 | 112.208 | 111.843 |

| Additional paid-in capital | 384.687 | 376.399 | |

| Retained earnings | 88.372 | 4.903 | |

| Currency translation reserve | 6.726 | 2.241 | |

| Equity attributable to the owners of AIXTRON SE | 591.993 | 495.386 | |

| Non-controlling interests | 173 | 992 | |

| Total equity | 592.166 | 496.378 | |

| Other non-current liabilities | 27 | 3.296 | 2.617 |

| Other non-current provisions | 23 | 4.521 | 3.979 |

| Deferred tax liabilities | 14 | 654 | 0 |

| Total non-current liabilities | 8.471 | 6.596 | |

| Trade payables | 24 | 19.585 | 10.846 |

| Contract liabilities for advance payments | 26 | 77.041 | 50.824 |

| Other current provisions | 23 | 27.271 | 16.188 |

| Other current liabilities | 24 | 6.433 | 7.379 |

| Current tax payables | 10 | 9.729 | 2.215 |

| Total current liabilities | 140.059 | 87.452 | |

| Total liabilities | 148.530 | 94.048 | |

| Total liabilities and equity | 740.696 | 590.426 |

See accompanying notes to consolidated financial statements.

| in EUR thousands | Note | 2021 | 2020 |

| Cash flow from operating activities | |||

| Profit for the year | 94.839 | 34.470 | |

| Adjustments to reconcile net profit to net cash from operating activities | |||

| Expense from share-based payments | 3.860 | 1.129 | |

| Depreciation, amortization and impairment expense | 11, 12 | 9.829 | 9.547 |

| Net result from disposal of property, plant and equipment | 5, 6 | 83 | 51 |

| Adjusmtents for fair value valuation of financial assets at fair value through profit or loss |

659 | 0 | |

| Deferred income taxes | 9 | -9.569 | -3.310 |

| Interest and lease repayments shown under investing or financing activities | 8, 27 | 906 | 619 |

| Change in | |||

| Inventories | -39.756 | -677 | |

| Trade receivables | -39.415 | -12.880 | |

| Other assets | -3.802 | -3.312 | |

| Financial assets at fair value through profit or loss | -79.862 | -62.422 | |

| Trade payables | 8.067 | -7.742 | |

| Provisions and other liabilities | 16.713 | 2.222 | |

| Non-current liabilities | -452 | 2.220 | |

| Advance payments from customers | 24.404 | 923 | |

| Net cash provided by operating activities | -13.496 | -39.162 | |

| Investing | |||

| Capital expenditures in property, plant and equipment | 11 | -16.388 | -7.847 |

| Capital expenditures in intangible assets | 12 | -1.060 | -1.443 |

| Proceeds from disposal of property, plant and equipment | -13 | 24 | |

| Proceeds from disposal of intangible assets | 53 | 0 | |

| Interest received | 8, 27 | 169 | 285 |

| Bank deposits with a maturity of more than 90 days | 17 | 0 | -32.500 |

| Investments in other financial assets | -250 | 0 | |

| Net cash provided by (used in) investing activities | -17.489 | -41.481 | |

| Financing | |||

| Proceeds from the issue of equity shares | 4.793 | 0 | |

| Interest paid | 8, 27 | -111 | -27 |

| Repayment of lease liabilities | 27 | -964 | -877 |

| Dividend paid | -12.303 | 0 | |

| Net cash provided by (used in) financing activities | -8.585 | -904 | |

| Effect of changes in exchange rates on cash and cash equivalents | 3.174 | -2.013 | |

| Net change in cash and cash equivalents | -36.396 | -83.560 | |

| Cash and cash equivalents at the beginning of the period | 187.259 | 270.819 | |

| Cash and cash equivalents at the end of the period | 18 | 150.863 | 187.259 |

| Net cash provided by operating activities includes: | |||

| Income taxes paid | -7.651 | -5.973 | |

| Income taxes received | 99 | 271 |

See accompanying notes to consolidated financial statements.

| in EUR thousands | Subscribed capital under IFRS |

Additional paid-in capital |

Currency translation | Retained earnings or losses |

Shareholders' equity attributable to the owners of AIXTRON SE | Non-controlling interests |

Total |

| Balance January 1, 2020 | 111.840 | 375.273 | 5.564 | -29.955 | 462.722 | 1.422 | 464.144 |

| Share-based payments | 1.129 | 1.129 | 1.129 | ||||

| Issue of shares | 3 | -3 | 0 | ||||

| Profit for the year | 34.879 | 34.879 | -409 | 34.470 | |||

| Other comprehensive loss | -3.323 | -21 | -3.344 | -21 | -3.365 | ||

| Total comprehensive income for the year |

-3.323 | 34.858 | 31.535 | -430 | 31.105 | ||

| Balance December 31, 2020 and January 1, 2021 |

111.843 | 376.399 | 2.241 | 4.903 | 495.386 | 992 | 496.378 |

| Dividends | -12.303 | -12.303 | -12.303 | ||||

| Share-based payments | 3.860 | 3.860 | 3.860 | ||||

| Issue of shares | 365 | 4.428 | 4.793 | 4.793 | |||

| Profit for the period | 95.660 | 95.660 | -821 | 94.839 | |||

| Other comprehensive income | 4.485 | 112 | 4.597 | 2 | 4.599 | ||

| Total comprehensive income for the year | 4.485 | 95.772 | 100.257 | -819 | 99.438 | ||

| Balance December 31, 2021 | 112.208 | 384.687 | 6.726 | 88.372 | 591.993 | 173 | 592.166 |

| 1. | General Principles | 126 |

| 2. | Significant Accounting Policies | 127 |

| 3. | Segment Reporting and Revenues | 143 |

| 4. | Research and Development | 147 |

| 5. | Other Operating Income | 147 |

| 6. | Other Operating Expenses | 148 |

| 7. | Personnel Expense | 148 |

| 8. | Net Finance Income | 149 |

| 9. | Income Tax Expense / Benefit | 149 |

| 10. | Current Tax Receivable and Payable | 151 |

| 11. | Property, Plant and Equipment and Leased Assets | 152 |

| 12. | Intangible Assets | 154 |

| 13. | Other Non-Current Financial Assets | 157 |

| 14. | Deferred Tax Assets and Deferred Tax Liabilities | 157 |

| 15. | Inventories | 159 |

| 16. | Trade Receivables and Other Current Assets | 160 |

| 17. | Other Financial Assets | 162 |

| 18. | Cash and Cash Equivalents | 162 |

| 19. | Shareholders’ Equity | 163 |

| 20. | Earnings Per Share | 165 |

| 21. | Employee Benefits | 166 |

| 22. | Share-Based Payment | 166 |

| 23. | Provisions | 170 |

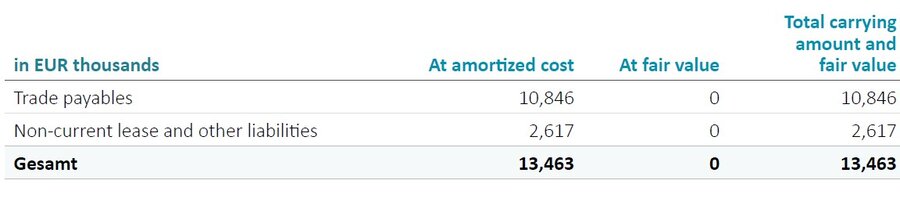

| 24. | Trade Payables and Other Current Liabilities | 171 |

| 25. | Financial Instruments | 171 |

| 26. | Advance Payments – Contract Liabilities | 176 |

| 27. | Leases | 177 |

| 28. | Restructuring Costs | 178 |

| 29. | Capital Commitments | 179 |

| 30. | Contingencies | 179 |

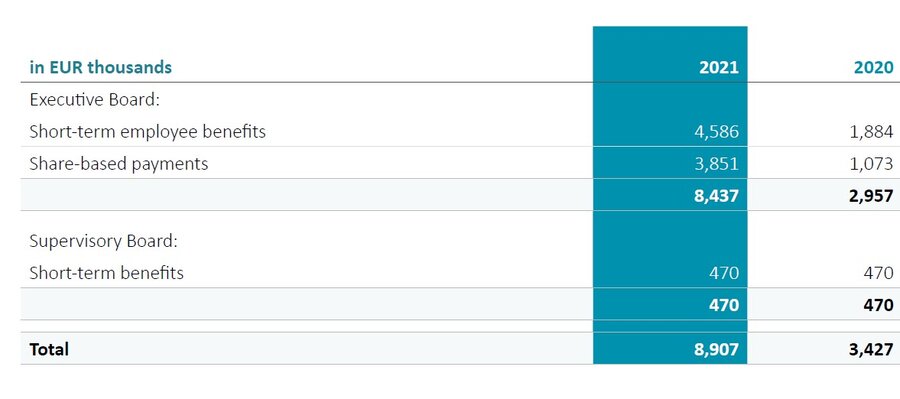

| 31. | Related Parties | 179 |

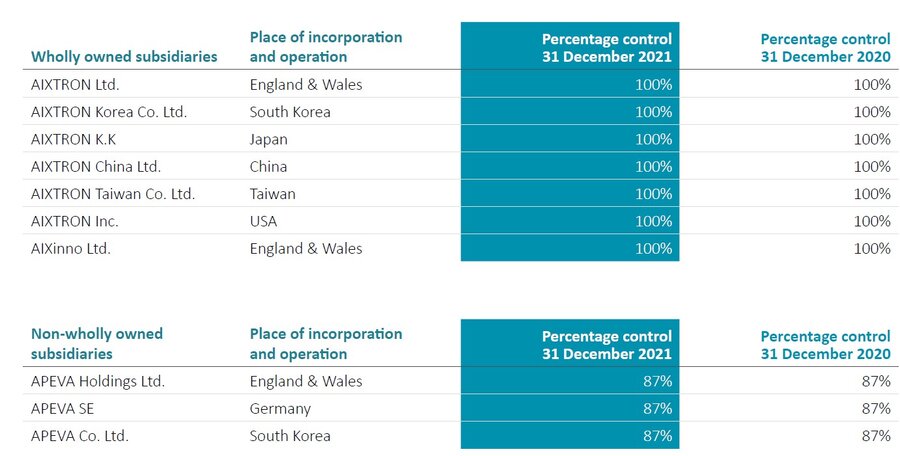

| 32. | Consolidated Entities | 180 |

| 33. | Events After the Reporting Period | 181 |

| 34. | Auditors’ Fees | 181 |

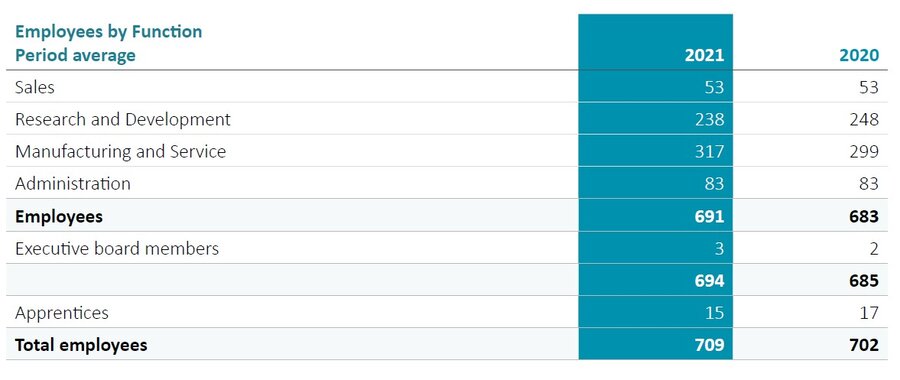

| 35. | Employees | 182 |

| 36. | Supervisory Board and Executive Board | 182 |

| 37. | Critical Accounting Judgments and Key Sources of Estimation and Uncertainty | 184 |

Erläuterungen siehe Anhang zum Konzernabschluss.

AIXTRON SE (“Company”) is incorporated as a European Company (Societas Europaea) under the laws of the Federal Republic of Germany. The Company is domiciled at Dornkaulstraße 2, 52134 Herzogenrath, Germany. AIXTRON SE is registered in the commercial register of the District Court (“Amtsgericht”) of Aachen under HRB 16590.

The consolidated financial statements of AIXTRON SE and its subsidiaries (“AIXTRON“ or “Group“) have been prepared in accordance with, and fully comply with

AIXTRON is a leading provider of deposition equipment to the semiconductor industry. The Group's technology solutions are used by a diverse range of customers worldwide to build advanced components for electronic and opto-electronic applications based on compound, silicon, or organic semiconductor materials. Such components are used in fiber optic communication systems, wireless and mobile telephony applications, optical and electronic storage devices, computing, signaling, and lighting, displays, as well as a range of other leadingedge technologies.

These consolidated financial statements have been prepared by the Executive Board and have been submitted to the Supervisory Board at its meeting held on February 23, 2022 for approval and publication.

Companies included in consolidation are AIXTRON SE, and companies controlled by AIXTRON SE. The balance sheet date of all consolidated companies is December 31. A list of all consolidated companies is shown in note 32.

The consolidated financial statements are presented in Euro (EUR). The amounts are rounded to the nearest thousand Euro (kEUR).

The financial statements have been prepared on the historical cost basis, except for the revaluation of certain financial instruments.

The preparation of financial statements in conformity with IFRS requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the balance sheet date and the reported amounts of income and expenses during the reported period. Actual results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the period in which the estimate is revised if this revision affects only that period, or in the period of the revision and future periods if the revision affects both current and future periods. Judgments which have a significant effect on the Group’s financial statements are described in note 37.

The accounting policies set out below have been applied consistently to all periods presented in these consolidated financial statements.

The accounting policies have been applied consistently by each consolidated company.

The consolidated financial statements incorporate the financial statements of the Company and entities controlled by the Company (its subsidiaries) made up to 31 December each year.

Control is achieved when the Company:

The Company reassesses whether or not it controls an investee if facts and circumstances indicate that there are changes to one or more of the three elements of control listed above.

Entities over which AIXTRON SE has control are treated as subsidiaries (see note 32). The results of subsidiaries are included in the consolidated financial statements from the date that control commences until the date that control ceases.

All intercompany income and expenses, transactions and balances have been eliminated in the consolidation.

The consolidated financial statements have been prepared in Euro (EUR). In the translation of financial statements of subsidiaries outside the Euro-Zone the local currencies are also the functional currencies of those companies. Assets and liabilities of those companies are translated to EUR at the exchange rate as of the balance sheet date. Revenues and expenses are translated to EUR at average exchange rates for the year or at average exchange rates for the period between their inclusion in the consolidated financial statements and the balance sheet date. Net equity is translated at historical rates. The differences arising on translation are disclosed in the consolidated statement of changes in equity.

Exchange gains and losses resulting from fluctuations in exchange rates in the case of foreign currency transactions are recognized in the income statement in „other operating income“ or „other operating expenses“.

Items of property, plant and equipment are stated at cost, plus ancillary charges such as installation and delivery costs, less accumulated depreciation (see below) and impairment losses (see accounting policy (j)).

Costs of internally generated assets include not only costs of material and personnel, but also a share of directly attributable overhead costs, such as employee benefits, delivery costs, installation, and professional fees.

Where parts of an item of property, plant and equipment have different useful lives, they are depreciated as separate items of property, plant and equipment.

Die im Zusammenhang mit der Anschaffung oder Herstellung von eigenen Vermögenswerten stehenden Zuwendungen der öffentlichen Hand werden zum Zeitpunkt der Aktivierung anschaffungs- bzw. herstellungskostenmindernd berücksichtigt.

AIXTRON recognizes in the carrying amount of an item of property, plant and equipment the cost of replacing components or enhancement of such an item when that cost is incurred if it is probable that the future economic benefits embodied in the item will flow to the Group and the cost of the item can be measured reliably. All other costs such as repairs and maintenance are expensed as incurred.

Government grants related to the acquisition or manufacture of owned assets are deducted from original cost at the date of capitalization.

Depreciation is charged on a straight-line basis over the estimated useful lives of each part of an item of property, plant and equipment. Useful lives, depreciation method and residual values of property, plant and equipment are reviewed at the year-end date or more frequently if circumstances arise which are indicative of a change.

The estimated useful lives are as follows:

The useful lives of leased assets do not exceed the expected lease periods.

AIXTRON assesses whether a contract is, or contains, a lease, at inception of the contract.

The Group recognizes a lease asset and a corresponding lease liability with respect to all lease arrangements in which it is the lessee, except for short-term leases (defined as leases with a lease term of 12 months or less) and leases of low value assets (such as tablets and personal computers, small items of office furniture and telephones). For these leases, the Group recognizes the lease payments as an operating expense on a straight-line basis over the term of the lease unless another systematic basis is more representative of the time pattern in which economic benefits from the leased assets are consumed.

AIXTRON recognizes a leased asset and a lease liability at the lease commencement date. The leased asset is initially measured at cost, which comprises the initial amount of the lease liability adjusted for any lease payments made at or before the commencement date, plus any initial direct costs incurred and an estimate of costs to dismantle and remove the underlying asset or to restore the underlying asset or the site on which it is located, less any lease incentives received.

The right-of-use assets are presented in property, plant and equipment, and leased assets in the consolidated statement of financial position.

The leased asset is subsequently depreciated using the straight-line method from the commencement date to the earlier of the end of the useful life of the asset or the expected end of the lease term. The estimated useful lives of leased assets are determined on the same bases as those of property, plant and equipment. In addition, the leased asset is periodically tested and reduced by impairment losses, if any, and adjusted for certain remeasurements of the lease liability.

The lease liability is initially measured at the present value of the lease payments that are not paid at the commencement date, discounted using the interest rate implicit in the lease or, if that rate cannot be readily determined, the company’s incremental borrowing rate.

The lease liabilities are included in other non-current payables and other current liabilities in the consolidated statement of financial position. Lease payments included in the measurement of the lease liability comprise fixed payments, less any lease incentives and variable lease payments that depend on an index or rate, initially measured using the index or rate at the commencement date.

The lease liability is measured at amortised cost using the effective interest method. It is remeasured when there is a change in future lease payments arising from a change in index or rate, or if the company changes its assessment of whether it will exercise a purchase, extension or termination option.

When the lease liability is remeasured in this way, a corresponding adjustment is made to the# carrying amount of the leased asset, or is recorded in profit or loss if the carrying amount of the leased asset has been reduced to zero.

The Group did not make any such adjustments during the periods presented.

Business combinations are accounted for by applying the purchase method. Goodwill is stated at cost less any accumulated impairment loss. Goodwill is allocated to cash-generating units and is tested annually for impairment (see accounting policy (j)).

Expenditure on research activities, undertaken with the prospect of gaining new technical knowledge and understanding using scientific methods, is recognized as an expense as incurred. Expenditure on development comprises costs incurred with the purpose of using scientific knowledge technically and commercially. As not all criteria of IAS 38 are met AIXTRON does not capitalize such costs.

Other intangible assets that are acquired are stated at cost less accumulated amortization (see below) and impairment losses (see accounting policy (j)). Intangible assets acquired through business combinations are stated at their fair value at the date of purchase. Expenditure on internally generated goodwill, trademarks and patents is expensed as incurred.

Subsequent expenditure on capitalized intangible assets is capitalized only when it increases the future economic benefits embodied in the specific asset to which it relates. All other expenditure is expensed as incurred.

Amortization is charged on a straight-line basis over the estimated useful lives of intangible assets, except for goodwill. Goodwill has a useful life which is indefinite and is tested annually in respect of its recoverable amount. Other intangible assets are amortized from the date they are available for use. Useful lives and residual values of intangible assets are reviewed at the year-end date or more frequently if circumstances arise which are indicative of a change.

The estimated useful lives are as follows:

Financial assets are classified into the following specific categories: financial assets ‘at fair value through profit or loss’ (FVTPL), ‘at fair value through other comprehensive income (FVTOCI), and ‘at amortized cost’. The classification depends on the nature and purpose of the financial assets and is determined at the time of initial recognition.

AIXTRON did not have any financial assets in these categories during the periods covered by this report.

Financial assets are measured at amortized cost as they are held within a business model to collect contractual cash flows and these cash flows consist solely of payments of principal and interest on the principal amount outstanding.

All financial assets not classified as measured at amortized cost or FVTOCI under IFRS 9 are measured at fair value through profit and loss (FVTPL). Financial assets at FVTPL are measured at fair value at the end of each reporting period, with any fair value gains or losses recognized in profit or loss. The gain or loss including dividends earned on financial asset and is included in profit and loss account and in note 5 or 6 respectively.

Fair value is determined in accordance with IFRS 13.

Trade receivables and other receivables are measured at amortized cost as they are held within a business model to collect contractual cash flows and these cash flows consist solely of payments of principal and interest on the principal amount outstanding.

The Group recognizes a loss allowance for expected credit losses (ECL) on trade receivables and contract assets. The amount of expected credit losses is updated at each reporting date to reflect changes in credit risk since initial recognition of the respective financial instrument. The Group always recognizes lifetime ECL for trade receivables, and contract assets. The expected credit losses on these financial assets are estimated using a provision matrix based on the Group’s historical credit loss experience, adjusted for factors that are specific to the debtors, general economic conditions and an assessment of both the current as well as the forecast direction of conditions at the reporting date, including time value of money where appropriate.

For all other financial instruments, the Group recognizes lifetime ECL when there has been a significant increase in credit risk since initial recognition. However, if the credit risk on the financial instrument has not increased significantly since initial recognition, the Group measures the loss allowance for that financial instrument at an amount equal to 12‑month ECL. Lifetime ECL represents the expected credit losses that will result from all possible default events over the expected life of a financial instrument. In contrast, 12‑month ECL represents the portion of lifetime ECL that is expected to result from default events on a financial instrument that are possible within 12 months after the reporting date.

Cash and cash equivalents comprise cash on hand and deposits with banks with a maturity of less than three months at inception.

Equity instruments, including share capital, issued by the Group are recorded at the proceeds received, net of direct issue costs.

Financial liabilities are classified as either financial liabilities “at FVTPL” or "at amortized cost".

AIXTRON did not have any financial liabilities in this category during the periods covered by this report.

Other financial liabilities, including trade payables, are measured at amortized cost.

The Group’s activities expose it to the financial risks of changes in foreign exchange currency rates (see note 25). AIXTRON may use foreign exchange forward contracts to hedge these exposures. AIXTRON does not use derivative financial instruments for speculative purposes.

The use of financial derivatives is governed by policies approved by the Executive Board, which provide written principles on the use of financial derivatives. AIXTRON did not have any derivative financial instruments in the periods covered by this report.

Inventories are stated at the lower of cost and net realizable value. Net realizable value is the estimated selling price in the ordinary course of business, less the estimated cost of completion and selling expenses. Cost is determined using weighted average cost.

The cost includes expenditures incurred in acquiring the inventories and bringing them to their existing location and condition. In the case of work in progress and finished goods, cost includes direct material and production cost, as well as an appropriate share of overheads based on normal operating capacity. Scrap and other wasted costs are expensed on a periodic basis either as cost of sales or, in the case of beta tools as research and development expense.

Allowance for slow moving, excess and obsolete, and otherwise unsaleable inventory is recorded based primarily on either the estimated forecast of product demand and production# requirement or historical usage. When the estimated future demand is less than the inventory, AIXTRON writes down such inventories.

Operating result is stated before finance income, finance expense and tax.

Goodwill purchased as part of a business acquisition is tested annually for impairment, irrespective of whether there is any indication of impairment. For impairment test purposes, the# goodwill is allocated to cash-generating units. Impairment losses are recognized to the extent that the carrying amount exceeds the higher of fair value less costs of disposal or value in use of the cash-generating unit. Details of impairment test are shown in note 12.

Property, plant and equipment as well as other intangible assets are tested for impairment, where there is any indication that the asset may be impaired. The Group assesses at the end of each period whether there is an indication that an asset may be impaired. Impairment losses on such assets are recognized, to the extent that the carrying amount exceeds both the fair value that would be obtainable from a disposal in an arm’s length transaction, and the value in use.

In assessing value in use, the estimated future cash flows are discounted to their present value using a pre-tax discount rate that reflects current market assessments and the risks associated with the asset.

Impairment losses are reversed if there has been a change in the estimates used to determine the recoverable amount. Reversals are made only to the extent that the carrying amount of the asset does not exceed the carrying amount that would have been determined if no impairment loss had been recognized.

An impairment loss in respect of goodwill is not reversed.

Basic earnings per share are computed by dividing net income (loss) by the weighted average number of issued common shares for the year. Diluted earnings per share reflect the potential dilution that could occur if options issued under the Company’s stock option plans were exercised unless such exercises had an anti-dilutive effect.

Obligations for contributions to defined contribution pension plans are recognized as an expense in the income statement as incurred.

The stock option programs from 2007 and 2012 allow members of the Executive Board, management, and employees of the Group to acquire shares of AIXTRON SE. The contractual terms of these share programs are presented in note 22. These stock option programs are accounted for according to IFRS 2 for equity-settled share-based payment transactions. The fair value of options granted is recognized as personnel expense with a corresponding increase in additional paid-in capital. The fair value is calculated at grant date and spread over the period during which the employees become unconditionally entitled to the options. The fair value of the options granted is measured using a mathematical model, taking into account the terms and conditions upon which the options were granted. The vesting conditions relate to a service condition and a market condition in relation to the share price of AIXTRON SE. In the calculation of the personnel expense options forfeited during the performance period are taken into account.

Executive Board remuneration system at AIXTRON SE consists long-term variable remuneration incentives (LTI) granted in shares of AIXTRON SE. These equity-settled share-based payments are measured at fair value of the equity instruments at the grant date. The fair value of the shares granted is measured using a mathematical model, taking into account the terms and conditions upon which the shares were granted. Further details regarding the equity-settled share-based transactions are set out in note 22 and 31.

The fair value determined at the grant date of the equity-settled share-based payments is expensed on a straight-line basis over the performance period, based on the Group’s estimate of the number of equity instruments expected to vest. For non-market-based vesting conditions, the Group reviews its estimate of number of equity instruments at each reporting date during vesting period. The impact of the revision of the original estimates, if any, is recognized in profit or loss and a corresponding adjustment is recognized to equity.

A provision is recognized when the Group has a present legal or constructive obligation as a result of a past event, and it is probable that an outflow of economic benefits will be required to settle this obligation. If the effect is material, provisions are determined by discounting the expected future cash flows at a pre-tax interest rate that reflects current market assessments of the time value of money and, where appropriate, the risks associated with the liability.

The Group normally offers one- or two-year warranties on all of its products. Warranty expenses generally include cost of labor, material and related overhead necessary to repair a product free of charge during the warranty period. The specific terms and conditions of those warranties may vary depending on the equipment sold, the terms of the contract and the locations from which they are sold. The Group establishes the costs that may be incurred under its warranty obligations and records a liability in the amount of such costs at the time revenue is recognized. Factors that affect the warranty liability include the historical and anticipated rates of warranty claims and cost per claim.

The Group accrues warranty cost for systems shipped based upon historical experience. The Group periodically assesses the adequacy of its recorded warranty provisions and adjusts the amounts as necessary.

Extended warranties, beyond the normal warranty periods, are treated as maintenance services in accordance with (n) below.

A provision for onerous contracts is recognized when the expected economic benefits to be derived by the Group from a contract are lower than the unavoidable cost of meeting its obligations under the contract. The amount recognized as a provision is determined as the excess of the unavoidable costs of meeting the obligations under the contract over the economic benefits expected to be received. Before making that provision any impairment loss that has occurred on assets dedicated to that contract are recognized. The provision is discounted to present value if the adjustment is material.

A restructuring provision is recognized when the Group has developed a detailed formal plan for the restructuring and the parties concerned have been informed. The measurement of restructuring provision includes only the direct expenditures arising from the restructuring, which are those amounts that are both necessarily entailed by the restructuring and not associated with the ongoing activities of the entity.

AIXTRON enters contracts with customers for goods and services, including combinations of goods and services. Contracts are usually for fixed prices and do not offer any unilateral right of return to the customer.

Revenue is generated from the following major sources:

Revenue is recognized when the Group satisfies a performance obligation in contracts with its customers by transferring control of goods or services to the customer and it is probable that the economic benefits associated with the transaction will flow to the entity.

The sale of equipment involves acceptance tests at AIXTRON´s production facility. After successful completion of this test, the equipment is dismantled and packaged for shipment.

Revenues from the sale of products that have been demonstrated to meet product specification requirements are recognized at a point in time upon shipment to the customer if full acceptance tests have been successfully completed at the AIXTRON production facility and control has passed to the customer and the customer can benefit from the product either on its own or with other resources that are readily available.

Upon arrival at the customer site the equipment is reassembled and installed, which is a service generally performed by AIXTRON engineers. Revenue relating to the installation of the equipment is recognized at the point in time when AIXTRON has fulfilled its performance obligations under the contract and control of the goods has passed to the customer.

Revenue related to equipment where meeting the product specification requirements has not yet been demonstrated or the customer cannot benefit from the product either on its own or with other resources that are readily available, or where specific rights of return have been negotiated, is recognized only at the point in time when the customer finally accepts the equipment and has control.

Revenue for the sale of equipment which is built for a specific customer and does not have an alternative use is recognized over time based on milestones for the particular contract and the extent to which the Group’s performance obligations have been satisfied. Typically, these contracts relate to a small number of upgrades to equipment already belonging to the customer.

Revenue related to spares is recognized at the point in time at which the customer obtains control of the goods, generally at the point of delivery.

Revenue related to services is recognized either at the point in time at which the service, such as a repair, is delivered and the customer obtains control of the related item, or for services such as extended warranty, revenue is recognized over time during the period in which it is provided.

AIXTRON gives no general rights of return, settlement discounts, credits or other sales incentives within its terms of sale. The consideration from contracts which include combinations of different performance obligations such as equipment, spares and services is allocated to each performance obligation in an amount that depicts the amount of consideration to which the Group expects to be entitled in exchange for transferring the goods or services to the customer.

The Group uses a combination of methods such as an estimated cost plus margin approach, and allocating discounts from list price proportionately to each performance obligation when determining the consideration for each performance obligation.

The portion of equipment revenue related to installation services is determined based on either the fair value of the installation services or, if the Group determines that there may be a risk that the economic benefits of installation services may not flow to the Group, the portion of the contract amount that is due and payable upon completion of the installation.

Fair value of the installation services corresponds to the part of the transaction price that the Group would be expected to receive as consideration in exchange for this service in the sale of such an equipment.

Cost of sales includes such direct costs as materials, labor, and related production overheads.

Research and development costs are expensed as incurred. Costs of beta tools which do not qualify to be recognized as an asset are expensed as research and development costs.

Project funding received from governments (e.g. state funding) and the European Union is recorded in other operating income, if the research and development costs are incurred and provided that the conditions for the funding have been met.

Payments made under leases for assets which have not been capitalized are recognized as expense on a straight-line basis over the term of the lease.

Government grants awarded for project funding are recorded in other operating income if the research and development costs are incurred and provided that the conditions for the funding have been met.

Government grants awarded to support continued employment where work is not allowed are recorded as a reduction in the related expense, as this presents the underlying reason for the grant better.

The tax expense represents the sum of the current and deferred tax. A deferred tax asset is recognized only to the extent that it is probable that future taxable profits can be set off against timing differences and tax losses carried forward or taxable temporary differences exist. Deferred tax assets are reduced to the extent that it is no longer probable that the related tax benefit can be realized. The recoverability of deferred tax assets is reviewed at least annually.

Deferred tax assets and liabilities are recorded for temporary differences between tax and commercial balance sheets and for losses brought forward for tax purposes as well as for tax credits of the companies included in consolidation. The deferred taxes are calculated, based on tax rates applicable at the balance sheet date or known to be applicable in the future.

Effects of changes in tax rates on the deferred tax assets and liabilities are recognized upon substantively enacted amendments to the law.

An operating segment is a component of the Group that is engaged in business activities and whose operating results are reviewed regularly by the Chief Operating Decision Maker, which AIXTRON considers to be its Executive Board, to make decisions about resources to be allocated to the segment and assess its performance and for which discrete financial information is available. AIXTRON has only one reportable segment.

Accounting standards applied in segment reporting are in accordance with the general accounting policies as explained in this section.

The cash flow statement is prepared in accordance with IAS 7. Cash flows from operating activities are prepared using the indirect method. Cash flows from taxes are included in cash flows from operating activities.

In the current year, the Group has applied the below amendments to IFRS standards and interpretations issued by the Board that are effective for an annual period that begins on or after 1 January 2021. Their adoption has not had any material impact on the disclosures or on the amounts reported in these consolidated financial statements.

| Initial application of Interest Rate Benchmark Reform amendments to IFRS 9/IAS 39, IFRS 7, IFRS 4 and IFRS 16 (Phase 2) |

The Group has adopted the Phase 2 amendments Interest Rate Benchmark Reform. Adopting these amendments enables the Group to reflect the effects of transitioning from interbank offered rates (IBOR) to alternative benchmark interest rates (also referred to as ‘risk free rates’ or RFRs) without giving rise to accounting impacts that would not provide useful information to users of financial statements. The change has had no impact on the Group |

| Initial application of COVID-19-Related Rent Concessions beyond June 30, 2021 - Amendment to IFRS 16 |

In prior year, the IASB issued COVID-19 Related Rent Concessions (Amendment to IFRS 16) that provides practical relief to lessees in accounting for rent concessions occurring as a direct consequence of COVID-19, by introducing a practical expedient to IFRS 16. This practical expedient was available to rent concessions for which any reduce in lease payments affected payments originally due on or before June 30, 2021. In current year, the Board issued COVID-19-Related Rent Concessions beyond June 30, 2021 that extends the practical expedient to apply reduction in lease payments originally due on or before June 30, 2022. The company has had no COVID-19 related rent concessions and therefore it has had no impact of the Group results. |

At the date of authorization of these consolidated financial statements, the Group has not applied following new and revised standards and interpretations which have been issued but are not yet effective. AIXTRON does not expect that the adoption of these standards will have a material impact on the financial statements of the Group in future periods.

| IFRS 17 | Insurance Contracts2) |

| IFRS 10 and IAS 28 (amendments) | Sale or contribution of assets between an Investor and its Associate or Joint Venture 3),4) |

| Amendments to IAS 1 | Classification of liabilities as current or non-current 2),4) |

| Amendments to IFRS 3 | Reference to the Conceptual Framework1) |

| Amendments to IAS 16 | Property, Plant and Equipment – Proceeds before Intended Use1) |

| Amendments to IAS 37 | Onerous Contracts – Cost of fulfilling a contract 1) |

| Annual Improvements to IFRS Standards 2018-2020 Cycle | Amendments to IFRS 1 First-time Adoption of International Financial Reporting Standards, IFRS 9 Financial Instruments, IFRS 16 Leases, and IAS 41 Agriculture1) |

| Amendments to IAS 1 and IFRS Practice Statement 2 | Disclosure of Accounting Policies2),4) |

| Amendments to IAS 8 | Definition of Accounting Estimates2),4) |

| Amendments to IAS 12 | Deferred Tax related to assets and liabilities arising from a single transaction2),4) |

1) Initial application to annual reporting periods beginning on or after 1 January 2022.

2) Initial application to annual reporting periods beginning on or after 1 January 2023.

3) The effective date of the amendments has yet to be set by the Board.

4) EU endorsement is still pending.

IFRS 8 requires operating segments to be identified on the basis of internal reports about components of the Group that are regularly reviewed by the Executive Board, as chief operating decision maker, in order to allocate resources to the segments and to assess their performance.

In the period 2020 to 2021 the Executive Board regularly reviewed financial information to allocate resources and assess performance only on a consolidated Group basis since the various activities of the Group are largely integrated from an operational perspective. In accordance with IFRS, AIXTRON has only one reportable segment.

The Group’s reportable segment is based around the category of goods and services provided to the semiconductor industry Revenues are recognized as disclosed in note 2 (n).

AIXTRON values the equipment revenue deferred for equipment installation services, using a market-based approach, based on observed transactions for all such contracts involving two elements where revenue has been recognized during the financial year. This is level 2 within the fair value hierarchy described in IFRS 13. The fair value of the installation services is taken as the most frequently observed (modal value) percentage of the contract price payable upon completion of the installation service. For the years 2020 to 2021, 10% of the revenue related to equipment is allocated for installation services.

For contracts where equipment revenue is recognized in two elements, the same method is also used to determine the fair value of products delivered, which is taken to be the most frequently observed (modal value) percentage of the contract value payable upon delivery of the equipment to the customer. This is also level 2 in the fair value hierarchy.

| in EUR thousands | Note | 2021 | 2020 |

| Equipment revenues | 366.512 | 223.018 | |

| Spares revenues | 57.599 | 41.348 | |

| Services revenues | 4.843 | 4.881 | |

| Revenue from external customers | 428.954 | 269.247 | |

| Inventories recognized as an expense | 15 | 177.983 | 113.801 |

| Reversals of inventory provisions | 15 | -585 | -1.029 |

| Obsolescence and valuation allowance expense for inventories | 15 | 2.851 | 1.918 |

| Personnel expense | 7 | 79.285 | 66.081 |

| Depreciation and impairment | 11 | 8.198 | 11.525 |

| Amortization | 12 | 1.631 | 931 |

| Other expenses | 71.278 | 53.904 | |

| Foreign exchange losses | 5 | 804 | 1.822 |

| Other operating income | 5 | -11.469 | -14.536 |

| Segment profit | 98.978 | 34.830 | |

| Finance income | 8 | 232 | 348 |

| Finance expense | 8 | -279 | -104 |

| Profit before tax | 98.931 | 35.074 |

Reversals of impairment allowances are included in other operating income as described in note 5. The accounting policies of the reportable segment are identical to the Group’s accounting policies as described in note 2. Segment profit represents the profit earned by the segment without the allocation of investment revenue, finance costs and income tax expense. This is the measure reported to the Executive Board for the purpose of resource allocation and assessment of performance.

The transaction price allocated to (partially) unsatisfied performance obligations at 31 December 2021 is Euro 214.6 million (31 December 2020: Euro 150.9 million). Management expects that approximately 82% of the transaction price allocated to the unsatisfied contracts as of the year ended 2021 will be recognized as revenue during 2022. The remaining amount will be recognized during the next financial year.

| in EUR thousands | 31.12.21 | 31.12.20 |

| Semi-conductor equipment segment assets | 361.110 | 264.884 |

| Unallocated assets | 379.586 | 325.542 |

| Total Group assets | 740.696 | 590.426 |

| in EUR thousands | 31.12.21 | 31.12.20 |

| Semi-conductor equipment segment liabilities | 138.147 | 91.833 |

| Unallocated liabilities | 10.383 | 2.215 |

| Total Group liabilities | 148.530 | 94.048 |

For the purpose of monitoring segment performance and allocating resources all assets other than tax assets, cash and other financial assets are treated as allocated to the reportable segment. All liabilities are allocated to the reportable segment apart from tax liabilities and post-employment benefit liabilities.

Additions and changes to property, plant and equipment, to goodwill and to intangible assets, and the depreciation and amortization expenses are given in notes 11 and 12. Other non-current financial assets decreased by kEUR 59,794 during 2021 (increased by kEUR 60,051 during 2020).

Information concerning other material items of income and expense for personnel expenses and R&D expenses can be found in notes 7 and 4.

The Group’s revenue from continuing operations from external customers and information about its non-current assets by geographical location are detailed below. Revenues from external customers are attributed to individual countries based on the country in which it is expected that the products will be used.

| in EUR thousands | 2021 | 2020 |

| Asia | 299.853 | 196.973 |

| Europe | 85.911 | 40.954 |

| Americas | 43.190 | 31.320 |

| Total | 428.954 | 269.247 |

Sales from external customers attributed to Germany, AIXTRON’s country of domicile, and to other countries which are of material significance are as follows:

| in EUR thousands | 2021 | 2020 |

| Germany | 37.110 | 12.235 |

| USA | 43.090 | 29.849 |

| China | 211.820 | 153.478 |

| Taiwan | 66.056 | 16.140 |

Revenues from all countries outside Germany were kEUR 391,844 and kEUR 257,012 for the years 2021 and 2020 respectively. In 2021 sales to one customer represented 12.1% of Group revenue, with no other customer exceeding 10%. During 2020 sales to one customer represented 10.4% of Group revenue, with no other customer exceeding 10%.140

| in EUR thousands | 31.12.21 | 31.12.20 |

| Asia | 1.373 | 1.124 |

| Europe excluding Germany | 18.123 | 14.653 |

| Germany | 118.793 | 111.810 |

| USA | 10.289 | 9.735 |

| Total Group non-current assets | 148.578 | 137.322 |

Non-current assets exclude deferred tax assets, financial instruments, post-employment benefit assets and rights arising under insurance contracts.

Research and development costs, before deducting project funding received, were kEUR 56,809 and kEUR 58,379 for the years ended December 31, 2021 and 2020 respectively.

After deducting project funding received and not repayable, net expenses for research and development were kEUR 47,876 and kEUR 50,327 for the years ended December 31, 2021 and 2020 respectively.

| in EUR thousands | 2021 | 2020 |

| Research and development funding | 8.933 | 8.052 |

| Income from resolved contract obligations | 0 | 315 |

| Compensation received | 10 | 535 |

| Foreign exchange gains | 1.964 | 1.027 |

| Gain on disposal of assets | 20 | 1 |

| Reversals of impairment allowance | 0 | 2.909 |

| Other | 542 | 1.697 |

| Total | 11.469 | 14.536 |

| in EUR thousands | 2021 | 2020 |

| Foreign exchange gains | 1.964 | 1.027 |

| Foreign exchange losses (see note 6) | -804 | -1.822 |

| Net foreign exchange gains (losses) | 1.160 | -795 |

The total amount of exchange gains and losses (see also note 6) recognized in profit or loss was a gain of kEUR 1,160 (2020: gain kEUR 795).

Compensation received in 2021 of kEUR 10 (2020: kEUR 535) is an insurance claim for damages incurred during shipment of goods. In 2021 the gain on disposal of assets amounted to kEUR 20 (2020: kEUR 1).

| in EUR thousands | 2021 | 2020 |

| Foreign exchange losses | 804 | 1.822 |

| Losses from the disposal of fixed assets | 103 | 52 |

| Additions to allowances for receivables or write-off of receivables | 0 | 12 |

| Financial assets at FVTPL | 708 | 16 |

| Other | 159 | 39 |

| Total | 1.774 | 1.941 |

The net loss of kEUR 708 in 2021 arose on financial assets required to be measured at FVTPL (2020: loss kEUR 16). The amount includes unrealized losses of kEUR 659 (2020: kEUR 0) and realized losses of kEUR 49 (2020: kEUR 16).

| in EUR thousands | 2021 | 2020 |

| Payroll | 65.966 | 56.263 |

| Social insurance contributions | 8.310 | 7.441 |

| Expense for defined contribution plans | 1.149 | 1.248 |

| Share-based payments | 3.860 | 1.129 |

| Total | 79.285 | 66.081 |

| in EUR thousands | 2021 | 2020 |

| Finance income | ||

| Interest income on bank deposits | 232 | 348 |

| On financial assets measured at amortised cost | 232 | 348 |

| Finance expense | ||

| Interest paid on bank overdrafts and balances | -172 | -35 |

| Interest expense on lease liabilities | -107 | -69 |

| On financial liabilities not at fair value through profit or loss and on financial assets | -279 | -104 |

| Net finance income | -47 | 244 |

The following table shows income tax expenses and income recognized in the consolidated income statement:

| in EUR thousands | 2021 | 2020 |

| Current tax expense (+)/current tax income (-) for current year | ||

| for current year | 13.810 | 3.958 |

| for prior years | -175 | -44 |

| Total current tax expense | 13.635 | 3.914 |

| Deferred tax expense (+)/deferred tax income (-) | ||

| - from temporary differences | -37 | -96 |

| - from changes in local tax rate | 16 | 2 |

| - from reversals and write-downs | -9.522 | -3.216 |

| Total deferred tax income | -9.543 | -3.310 |

| Income tax expense | 4.092 | 604 |

The income/loss before income taxes and income tax expense and income relate to the following regions:

| in EUR thousands | 2021 | 2020 |

| Income/loss before income taxes | ||

| Germany | 100.981 | 26.999 |

| Outside Germany | -2.050 | 8.075 |

| Total | 98.931 | 35.074 |

| Income tax expense/income | ||

| Germany | 4.218 | -400 |

| Outside Germany | -126 | 1.004 |

| Total | 4.092 | 604 |

The Group’s effective tax rate is different from the German statutory tax rate of 32.80% (2020: 32.80%);which is based on the German corporate income tax rate, including solidarity surcharge, and trade tax.

The following table shows the reconciliation from the expected to the reported tax expense:

| in EUR thousands | 2021 | 2020 |

| Net result before taxes | 98.931 | 35.074 |

| Income tax expense/benefit (German tax rate) | 32.449 | 11.504 |

| Effect from differences to foreign tax rates | -302 | -1.160 |

| Non-deductible expenses | 251 | 464 |

| Tax losses not recognized as assets | 1.685 | 173 |

| Recognition / derecognition of deferred tax assets | -9.587 | -3.665 |

| Effect from changes in local tax rate | 0 | 2 |

| Effect of the use of loss carryforwards | -20.661 | -5.986 |

| Effect of permanent differences | 27 | 3 |

| Other | 230 | -731 |

| Income tax expense | 4.092 | 604 |

| Effective tax rate | 4,1% | 1,7% |

In addition to the amount charged to profit or loss, the following amounts relating to tax have been recognized in other comprehensive income (OCI):

| in EUR thousands | 2021 | 2020 |

| Deferred tax from remeasurement of defined benefit obligation | 26 | 0 |

| Deferred tax related to items recognized in other comprehensive income | 26 | 0 |

As of December 31, 2021 the current tax receivable and payable, arising because the amount of tax paid in the current or in prior periods was either too high or too low, are kEUR 2,363 (2020: kEUR 949) and kEUR 9,729 (2020: kEUR 2,215) respectively.

| in EUR thousands | Land and buildings | Technical equipment | Other equipment |

Assets under construction |

Leased land and buildings |

Leased equipment |

Total |

| Cost | |||||||

| Balance at January 1, 2020 | 65.077 | 74.421 | 15.836 | 3.340 | 3.893 | 332 | 162.899 |

| Additions | 59 | 2.252 | 983 | 3.371 | 353 | 830 | 7.848 |

| Disposals | 0 | 2.197 | 32 | 14 | 475 | 401 | 3.119 |

| Transfers | 0 | 2.107 | 321 | -2.428 | 0 | 0 | 0 |

| Effect of movements in exchange rates | -130 | -142 | -113 | -48 | -188 | -4 | -625 |

| Balance at December 31, 2020 | 65.006 | 76.441 | 16.995 | 4.221 | 3.583 | 757 | 167.003 |

| Balance at January 1, 2021 |

65.006 | 76.441 | 16.995 | 4.221 | 3.583 | 757 | 167.003 |

| Additions | 83 | 3.661 | 1.438 | 11.207 | 1.916 | 37 | 18.342 |

| Disposals | 281 | 1.853 | 351 | 0 | 644 | 80 | 3.209 |

| Transfers | 0 | 2.837 | 422 | -3.259 | 0 | 0 | 0 |

| Effect of movements in exchange rates | 175 | 293 | 148 | 150 | 276 | 3 | 1.045 |

| Balance at December 31, 2021 | 64.983 | 81.379 | 18.652 | 12.319 | 5.131 | 717 | 183.181 |

| Depreciation and impairment losses | |||||||

| Balance at January 1, 2020 | 29.301 | 55.103 | 12.752 | 8 | 966 | 230 | 98.360 |

| Depreciation charge for the year | 2.815 | 3.854 | 1.176 | 0 | 883 | 234 | 8.962 |

| Impairments | 0 | 2.563 | 0 | 0 | 0 | 0 | 2.563 |

| Reversal of impairment | -2.909 | 0 | 0 | 0 | 0 | 0 | -2.909 |

| Disposals | 0 | 2.147 | 31 | 0 | 475 | 389 | 3.042 |

| Effect of movements in exchange rates | -120 | -134 | -90 | -1 | -54 | -1 | -400 |

| Balance at December 31, 2020 | 29.087 | 59.239 | 13.807 | 7 | 1.320 | 74 | 103.534 |

| Balance at January 1, 2021 | 29.087 | 59.239 | 13.807 | 7 | 1.320 | 74 | 103.534 |

| Depreciation charge for the year | 1.334 | 4.093 | 1.317 | 0 | 908 | 191 | 7.843 |

| Impairments | 0 | 355 | 0 | 0 | 0 | 0 | 355 |

| Disposals | 282 | 1.809 | 352 | 0 | 644 | 51 | 3.138 |

| Effect of movements in exchange rates | 168 | 199 | 118 | 1 | 86 | 2 | 574 |

| Balance at December 31, 2021 | 30.307 | 62.077 | 14.890 | 8 | 1.670 | 216 | 109.168 |

| Carrying amounts | |||||||

| At January 1, 2020 | 35.776 | 19.318 | 3.084 | 3.332 | 2.927 | 102 | 64.539 |

| At December 31, 2020 | 35.919 | 17.202 | 3.188 | 4.214 | 2.263 | 683 | 63.469 |

| At January 1, 2021 | 35.919 | 17.202 | 3.188 | 4.214 | 2.263 | 683 | 63.469 |

| At December 31, 2021 | 34.676 | 19.302 | 3.762 | 12.311 | 3.461 | 501 | 74.013 |

Depreciation expense amounted to kEUR 7,843 for 2021 and kEUR 8,962 for 2020 respectively. During each financial year, asset useful lives and residual values are reviewed in accordance with IFRS. There was no significant adjustment of asset useful lives and residual values in 2021. In 2020 the effect of the changes in asset useful lives and residual values has been to decrease the depreciation expense by kEUR 962 compared with the depreciation which would have occurred had the asset useful lives and residual values remained unchanged.

In 2021 AIXTRON reviewed the valuation of its property, plant and equipment and wrote down the value of some specific laboratory equipment that no longer had any economic value. An impairment expense of kEUR 355 was incurred (2020 kEUR 2,563).

In 2020 AIXTRON reviewed the valuation of its German production facilities and reversed an impairment allowance of kEUR 2,909 for one of the two production sites as we expect to continue to use this facility for production.

Assets under construction relates mainly to self-built systems for development laboratories and advanced payments made for laboratory equipment in 2021 and 2020.

Disclosures in respect of the underlying leases are shown in note 27.

| in EUR thousands | Goodwill | Other intangible assets | Total |

|

Cost |

|||

| Balance at January 1, 2020 | 89.490 | 46.267 | 135.757 |

| Additions | 0 | 1.444 | 1.444 |

| Effect of movements in exchange rates | -1.598 | -2.023 | -3.621 |

| Balance at December 31, 2020 | 87.892 | 45.688 | 133.580 |

| Balance at January 1, 2021 | 87.892 | 45.688 | 133.580 |

| Additions | 0 | 1.060 | 1.060 |

| Disposals | 0 | 1.168 | 1.168 |

| Effect of movements in exchange rates | -1.582 | -2.023 | -3.621 |

| Balance at December 31, 2021 | 89.474 | 47.302 | 136.776 |

| Amortisation and impairment losses | |||

| Balance at January 1, 2020 | 17.121 | 43.895 | 61.016 |

| Amortisation charge for the year | 0 | 931 | 931 |

| Effect of movements in exchange rates | -206 | -2.014 | -2.220 |

| Balance at December 31, 2020 | 16.915 | 42.812 | 59.727 |

| Balance at January 1, 2021 | 16.915 | 42.812 | 59.727 |

| Amortisation charge for the year | 0 | 1.175 | 1.175 |

| Impairments | 0 | 456 | 456 |

| Disposals | 0 | 1.116 | 1.116 |

| Effect of movements in exchange rates | 240 | 1.729 | 1.969 |

| Balance at December 31, 2021 | 17.155 | 45.056 | 62.211 |

| Carrying amounts | |||

| At January 1, 2020 | 72.369 | 2.372 | 74.741 |

| At December 31, 2020 | 70.977 | 2.876 | 73.853 |

| At January 1, 2021 | 70.977 | 2.876 | 73.853 |

| At December 31, 2021 | 72.319 | 2.246 | 74.565 |

Amortization and impairment expenses for other intangible assets are recognized in the income statement as follows:

| in EUR thousands | 2021 Amortization | 2020 Amortization | 2021 Impairment | 2020 Impairment |

| Cost of sales | 368 | 31 | 0 | 0 |

| General administration expenses | 724 | 808 | 0 | 0 |

| Research and development costs | 83 | 92 | 456 | 0 |

| 1,175 | 931 | 456 | 0 |

In 2021 AIXTRON wrote down the value of one IT project that no longer had any economic value and intangible assets in scope of the restructuring of APEVA Group. An impairment expense of kEUR 456 was incurred. In 2020 no impairment losses were incurred, and no reversals of impairment losses were made.

The amortization expected to be charged on other intangible assets in the future years is as follows:

in EUR thousands

| 2022 | 1.078 |

| 2023 | 641 |

| 2024 | 386 |

| 2025 | 88 |

| 2026 | 15 |

| After 2026 | 38 |

The actual amortization can differ from the expected amortization.

At the end of 2021 the Group assessed the recoverable amount of goodwill and determined that no impairment loss had to be recognized (2020: kEUR 0).

As at the end of 2021 the cash generating unit, to which the goodwill has been allocated, is the AIXTRON Group Semiconductor Equipment segment.

The recoverable amount of the cash-generating unit is determined through a fair value less cost to sell calculation. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. As AIXTRON has only one cash generating unit (CGU), market capitalization of AIXTRON, adjusted for a control premium, has been used to determine the fair value less cost to sell of the cash generating unit. This is level 2 in the hierarchy of fair value measures set out in IFRS 13.

As at December 31, 2021 the market capitalization of AIXTRON was Euro 2,005.2 million, based on a share price of Euro 17.87 and issued shares (excluding Treasury Shares) of 112,207,915.

In an orderly selling process costs are incurred. AIXTRON has used 1.5% to account for the costs to sell.

A control premium typically in the range 20%-40% is incurred in the acquisition of a company. A 20% premium has been applied in this test to adjust the market capitalization to the fair value. Market capitalization was also adjusted for net debt and tax assets prior to comparing it to the carrying amount of the CGU. The analysis shows that the fair value less costs to sell of the CGU AIXTRON exceeds its carrying amount and that Goodwill is not impaired.

|

Euro millions, except share price

|

Impairment Test 2021 |

Impairment Test 2020 |

Sensitivity Analysis 2021 No control premium |

|||||

| Share price-Euros | 17.87 | 14.27 | 5.36 | |||||

| Market capitalisation as of December 31 | 2,005.2 | 1,595.4 | 601.2 | |||||

| Costs to sell in percentage | 1.50 % | 1.50 % | 1.50 % | |||||

| Costs to sell | -30.1 | -23.9 | -9.0 | |||||

| Market capitalisation less cost to sell | 1,975.1 | 1,571.5 | 592.2 | |||||

| Control premium in percentage | 20.00 % | 20.00 % | 0.00 % | |||||

| Control premium | 395.0 | 341.3 | 0.0 | |||||

| Market capitalisation and control premium less cost to sell | 2,370.1 | 1,885.8 | 592.2 | |||||

| Net debt | -352.5 | -310.2 | -352.5 | |||||

| Tax assets | -16.7 | -13.1 | -16.7 | |||||

| Fair value less costs to sell of CGU | 2,000.9 | 1,562.4 | 223.0 | |||||

| Carrying amount of the CGU | 223.0 | 173.1 | 223.0 | |||||

| Surplus of fair value less cost to sell over carrying amount | 1,778.0 | 1,389.4 | 0.0 | |||||

| Surplus of fair value less cost to sell over carrying amount as a percentage | 797 % | 803 % | 0 % |

The fair value less costs to sell, which is the recoverable amount, exceeds the carrying amount of the CGU by 797% (2020: 803%).

A sensitivity analysis of the impairment test, in which the control premium is reduced to zero, shows that the carrying amount of the CGU would equal the recoverable amount should the market capitalization of AIXTRON fall by 70.0% (2020: 68.4%) to Euro 601.2 million (2020: Euro 503.9 million).

| in EUR thousands | 2021 | 2020 |

| Long-term deposits with a term of more than 12 months | 0 | 60.000 |

| Miscellaneous other non-current financial assets | 703 | 497 |

| Total | 703 | 60.497 |

Long-term deposits are cash deposits at banks. Miscellaneous other non-current financial assets mainly include security deposits for buildings.

The deposits are with a first-rate bank within the European Union and the company does not expect to incur any credit losses in respect of these deposits. The deposits are measured at amortized cost.

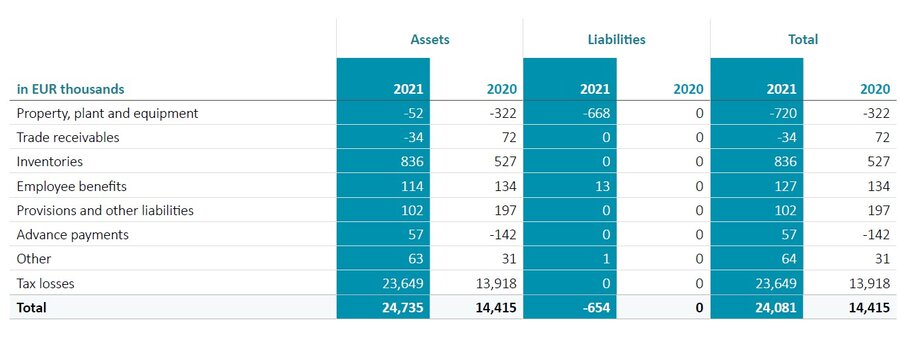

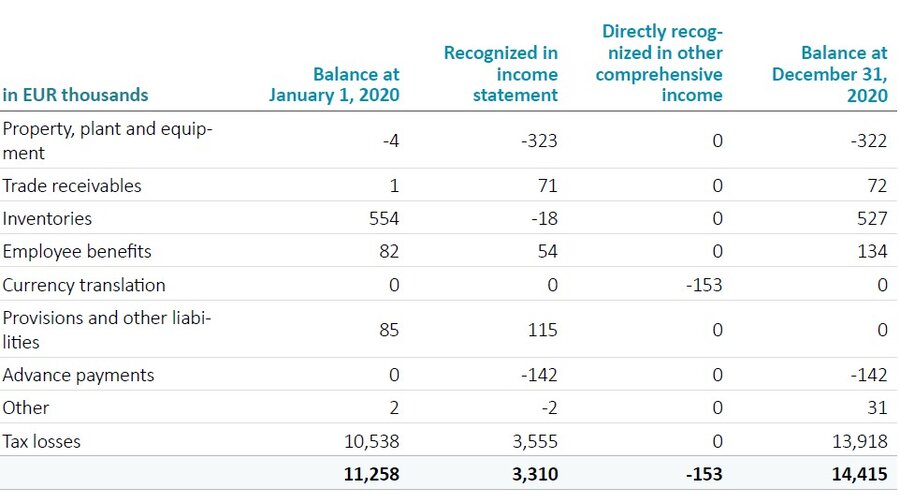

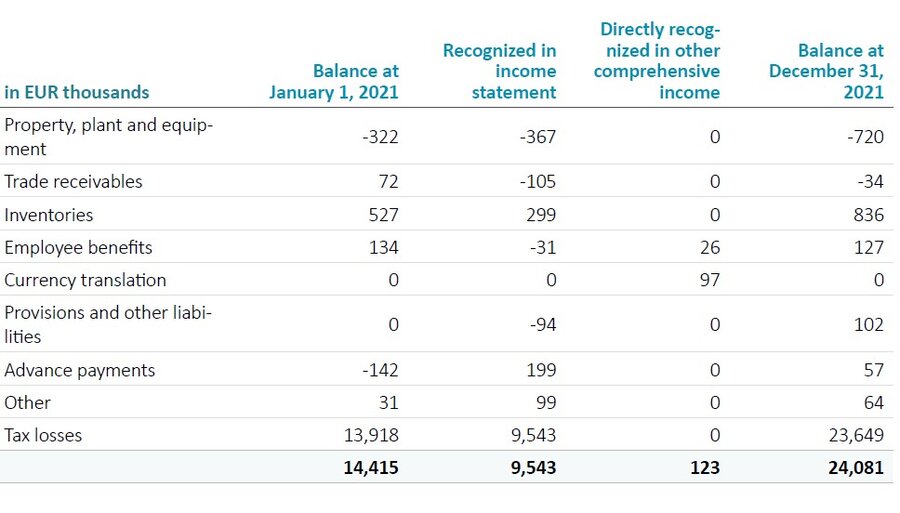

Deferred tax assets and liabilities are attributable to the following items:

Deferred tax assets are recognized at the level of individual consolidated companies in which a loss was realized in the current or preceding financial year, only to the extent that realization in future periods is probable. The nature of the evidence used in assessing the probability of realization includes forecasts, budgets and the recent profitability of the relevant entity.

The carrying amount of deferred tax assets for entities which have made a loss in either the current or preceding year was kEUR 427 (2020: kEUR 453).

Deferred taxes for tax losses in the amount of kEUR 99,429 (2020: kEUR 144,190) and on deductible temporary differences in the amount of kEUR 9,956 (2020: kEUR 7,765) were not recognized.

Tax losses in the amount of kEUR 90.694 can be used indefinitely (2020: kEUR 141,535), kEUR nil expire by 2026 (2020: kEUR nil, by 2025) and kEUR 8.735 expire after 2026 (2020: kEUR 10,420 after 2025).

The following table shows the development of deferred tax assets and liabilities during the financial year:

| in EUR thousands | 2021 | 2020 | |

| Raw materials and supplies | 55,738 | 33,944 | |

| Work in process | 57,222 | 35,718 | |

| Customer-specific work in process | 3,413 | 2,051 | |

| Inventories at customer's locations | 4,256 | 7,374 | |

| 120,629 | 79,087 |

| in EUR thousands | Note | 2021 | 2020 |

| Inventories recognized as an expense during the period | 3 | 177,983 | 113,801 |

| Reversals of write-downs recognized during the year | 3 | -585 | -1,029 |

| 177,398 | 112,772 | ||

| Write-down of inventories during the year | 3 | 2,851 | 1,918 |

| Inventories measured at net realisable value | 953 | 196 |

The reversal of write-downs recognized during the year in both 2021 and 2020 mainly relates to inventories which had been written down to their net realizable value and subsequently were sold.

Customer-specific work in process relates to work performed at the customers’ site, typically to install equipment or to upgrade customers’ existing equipment. Variations in the level of contract balances - work in process in the year have occurred because of the normal variations in the stage of completion of the work on individual contracts. Completion of installation is the final contractual deliverable in most customer contracts which typically allows any remaining payments to be received from the customer.

in EUR thousands

| 2021 | 2020 | |

| Trade receivables | 77.383 | 38.598 |

| Contract assets receivable | 3.579 | 2.732 |

| Allowances for doubtful accounts | 0 | -26 |

| Trade receivables - net | 80.962 | 41.304 |

| Prepaid expenses | 1.536 | 964 |

| Reimbursement of research and development costs | 1.318 | 2.088 |

| Advance payments to suppliers | 1.196 | 1.210 |

| VAT recoverable | 5.534 | 1.665 |

| Other assets | 654 | 1.244 |

| Total other current assets | 10.238 | 7.171 |

| Total trade receivables and other current assets | 91.200 | 48.475 |

Additions to allowances against trade receivables are included in other operating expenses, releases of allowances are included in other operating income. Allowances against receivables developed as follows:

| in EUR thousands | 2021 | 2020 |

| Allowance at January | 26 | 124 |

| Translation adjustments | 0 | -2 |

| Impairment losses recognized | 0 | 12 |

| Used | -5 | -108 |

| Impairment losses reversed | -21 | 0 |

| Allowance at December | 0 | 26 |

Ageing of past due but not impaired receivables:

| in EUR thousands | 2021 | 2020 |

| 1-90 days past due | 2.510 | 3.756 |

| More than 90 days past due | 134 | 355 |

Due to the worldwide spread of risks, there is a diversification of the credit risk for trade receivables. Generally, the Group demands no securities for financial assets. In accordance with usual business practice for capital equipment however, the Group mitigates its exposure to credit risk by requiring payment by irrevocable letters of credit and substantial payments in advance from most customers as conditions of contracts for sale of major items of equipment.

In 2021 three customers accounted for 28%, 12% and 12% of net trade receivables respectively. In 2020 three customers accounted for 16%, 11% and 10% of net trade receivables respectively. In determining concentrations of credit risk, the Group defines counterparties as having similar characteristics if they are connected entities.

Included in the Group’s trade receivable balance are debtors with a carrying amount of kEUR 2,644 (2020: kEUR 4,111) which are past due at the reporting date for which the Group has not provided. As there has not been a significant change in credit quality, and although the Group has no collateral, the amounts are considered recoverable.

The Group measures the loss allowance for trade receivables at an amount equal to the lifetime expected credit loss. Based on its experience, the Group uses a general provision rate for lifetime expected credit loss of 0%, adjusted for factors which are specific to the debtors, general economic conditions, and an assessment of both the current as well as the forecast direction of conditions at the reporting date. In determining receivables which may be individually impaired the Group has taken into account the likelihood of recoverability based on the past due nature of certain receivables, and our assessment of the ability of all counterparties to perform their obligations.

In 2021 other financial assets comprise fund investments and cash deposits at banks with a maturity of less than twelve months at inception of the contracts. In 2020 other financial assets comprise fund investments.

The composition of the other financial assets and the maturities at inception of the deposits were as below.

| in EUR thousands | 2021 | 2020 |

| Financial assets measured at FVTPL | 141.625 | 62.422 |

| Maturity less 12 months | 60.000 | 0 |

| Total other financial assets | 201.625 | 62.422 |

The fair value of fund investments is determined using the quoted prices in active markets at reporting date which is level one of the fair value hierarchy.

| in EUR thousands | 2021 | 2020 |

| Cash-in-hand | 2 | 3 |

| Bank balances | 150.861 | 187.256 |

| ash and Cash equivalents | 150.863 | 187.259 |

Cash and cash equivalents comprise short-term bank deposits with an original maturity of 3 months or less. The carrying amount and fair value are the same.

Bank balances included kEUR 0 given as security (2020: kEUR 0) at December 31, 2021.

| in EUR | 2021 | 2020 |

| January 1 | 112.927.320 | 112.927.320 |

| Shares issued during the year | 364.700 | 0 |

| Issued and fully paid capital at December 31, including Treasury Shares | 113.292.020 | 112.927.320 |

| Treasury shares | -1.084.105 | -1.084.105 |

| Issued and fully paid share capital at December 31 under IFRS | -1.084.105 | 111.843.215 |

The share capital of the Company consists of no-par value shares and was fully paid-up during 2021 and 2020. Each share represents a portion of the share capital in the amount of EUR 1.00.

Authorized share capital, including issued capital, amounted to EUR 201,284,934 (2020: EUR 201,284,934).

Additional paid-in capital mainly includes the premium on increases of subscribed capital as well as cumulative expense for share-based payments.

In 2021 364,700 new shares were issued within the scope of AIXTRON stock option plans (2020: nil). No treasury shares were transferred in 2021 as part of the share-based payments scheme (2020: 3,200 shares).

A dividend of kEUR 12,303 was paid to shareholders of AIXTRON SE in May 2021 (2020: kEUR 0).

The Group regards its shareholders’ equity as capital for the purpose of managing capital. Changes in Shareholders’ equity are shown in the consolidated statement of changes in equity. The Group considers its capital resources to be adequate.

Income and expenses recognized in other comprehensive income are shown in the statement of other comprehensive income.

The foreign currency translation adjustment comprises all foreign exchange differences arising from the translation of the financial statements of foreign subsidiaries whose functional currency is not the Euro.

During 2021 an income of kEUR 112 (2020: expense kEUR 21) was recorded from the remeasurement of defined benefit obligations in other comprehensive income.

The calculation of the basic earnings per share is based on the weighted-average number of common shares outstanding during the reporting period.

The calculation of the diluted earnings per share is based on the weighted-average number of outstanding common shares and of common shares with a possible dilutive effect resulting from share options being exercised under the share option plan.

| 0 | 2021 | 2020 |

| Earnings per share | ||

| Net profit attributable to the shareholders of AIXTRON SE in kEUR | 95.660 | 34.879 |

| Weighted average number of common shares for the purpose od earnings per share | 112.056.282 | 111.840.146 |

| Basic earnings per share (EUR) Earnings per share (diluted) |

0,85 | 0,31 |

| Net profit attributable to the shareholders of AIXTRON SE in kEUR | 95.660 | 34.879 |

| Weighted average number of common shares for the purpose od earnings per share | 112.056.282 | 111.840.146 |

| Dilutive effect of share options | 48.041 | 47.015 |

| Weighted average number of common shares for the purpose od earnings per share (diluted) | 112.104.323 | 111.887.161 |

| Diluted earnings per share (EUR) | 0,85 | 0,31 |

In 2021 and 2020 no share options existed that would be anti-dilutive.

Amounts recognized as distributions to shareholders during the financial year and the proposed dividend for the year ended December 31, 2021 are set out in the table below

| in EUR thousands | 2021 | 2020 |

| Final dividend payment for the financial year 2020:(2019: 0 cents per share) | 12.303 | 0 |

| Proposed dividend for the financial year 2021: 30 cents per share (2020: 11 cents per share) | 33.662 | 12.303 |

The Group grants retirement benefits to qualified employees through various defined contribution pension plans. In 2021 the expense recognized for defined contribution plans amounted to kEUR 1,149 (2020: 1,248).

In addition to the Group’s retirement benefit plans, the Group is required to make contributions to state retirement benefit schemes in the countries in which it operates. AIXTRON is required to contribute a specified percentage of payroll costs to the retirement schemes in order to fund the benefits. The only obligation of the Group is to make the required contributions.

Provisions for defined benefit pension plans in the amount of kEUR 200 (2020: kEUR 300) are reported under other non-current provisions.

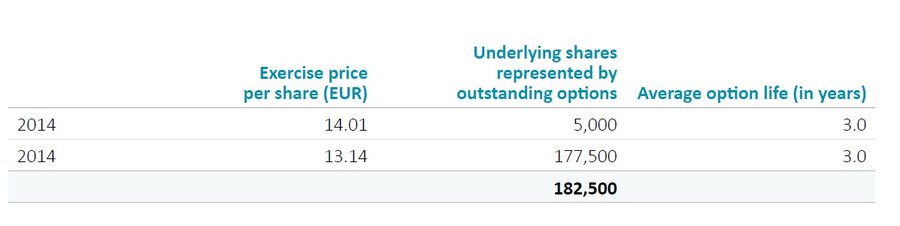

The Company has different fixed option plans which reserve shares of common stock for issuance to members of the Executive Board, management, and employees of the Group.

The Executive Board remuneration system at AIXTRON SE also consists long-term variable remuneration components (long-term incentive, LTI) that are granted in shares of AIXTRON SE.

The fair value of services received in return for shares or stock options granted is measured by reference to the fair value of the equity instruments or stock options granted..

The fair value of the shares and stock options is determined on the basis of a mathematical model. There were no expenses recognized for the existing programs in 2021 and 2020.

In May 2007, options were authorized to purchase 3,919,374 shares of common stock. 50% of the granted options may be executed after a waiting period of not less than two years, further 25% after three years and the remaining 25% after at least four years. The options expire 10 years after they have been granted. Under the terms of the 2007 plan, options were granted at prices equal to the average closing price over the last 20 trading days on the Frankfurt Stock Exchange before the grant date, plus 20%. There were no shares outstanding under this plan as of December 31, 2021.

In May 2012, options were authorized to purchase shares of common stock. The granted options may be exercised after a waiting period of not less than four years. The options expire 10 years after they have been granted. Under the terms of the 2012 plan, options are granted at prices equal to the average closing price over the last 20 trading days on the Frankfurt Stock Exchange before the grant date, plus 30%. Options to purchase 182,500 common shares were outstanding under this plan as of December 31, 2021.

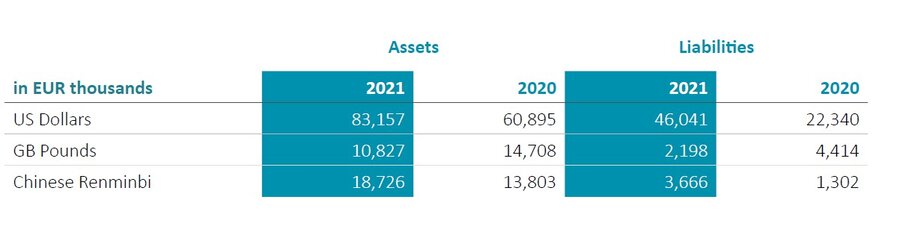

The amount of long-term performance-related remuneration (LTI) is geared to the performance of the Group over a 3-year reference period and is granted entirely in AIXTRON shares. Executive Board members may first dispose of these shares following a four-year holding period calculated from the start of the reference period. Before the start of a fiscal year, the Supervisory Board determines the long-term targets for each Executive Board member for the forthcoming reference period. Each Executive Board member receives forfeitable stock awards in the amount of the target LTI as a percentage of the consolidated net income for the year pursuant to the budget adopted for the fiscal year. The number of forfeitable stock awards is calculated based on the average of the closing prices on all stock market trading days in the final quarter of the previous year.