- / HOME

Supplementary Explanations According to HGB

The management report of AIXTRON SE and the Group management report of the AIXTRON Group are combined according to Section 315 Para. 5 HGB in conjunction with Section 298 Para. 2 HGB. The report is published in the Federal Gazette.

The annual financial statements of AIXTRON SE have been prepared in accordance with the German Commercial Code (HGB) and the German Stock Corporation Act (AktG). The annual financial statements generally serve to determine the balance sheet profit and thus the possible distribution amount.

The combined management report comprises all legally required information regarding AIXTRON SE. In addition to the reporting on the AIXTRON Group we explain the development of AIXTRON SE.

AIXTRON SE is the parent company of the AIXTRON Group and has its headquarters in Herzogenrath, Germany. The AIXTRON SE Management is responsible for key management functions for the Group, such as corporate strategy, risk management, investment management, executive and financial management, and communication with key target groups of the Group. AIXTRON SE generates the majority of its consolidated revenues through its operating activities of the development, production, sale and maintenance of equipment for the deposition of semiconductor materials. In addition to ten directly or indirectly wholly owned subsidiaries, which are primarily responsible for the worldwide distribution of AIXTRON's products, AIXTRON SE currently holds an 87% interest in the APEVA Group. AIXTRON SE is not managed separately using its own performance indicators because the Company is integrated into the Group management. We refer here to the respective explanations provided for the Group. The economic framework conditions of AIXTRON SE are essentially the same as those of the AIXTRON Group and are described in detail in the chapter Report on Economic Position.

AIXTRON SE’s revenues amounted to EUR 609.6 million in fiscal year 2023 and thus increased by EUR 177.5 million, or 41%, compared with the previous year (2022: EUR

432.1 million). Revenues were influenced by continued high demand for MOCVD systems in the fields of GaN- and SiC-power electronics, wireless and optical data communication as well as LED including micro LED applications. Other revenues are attributable to intra- group charges.

At 51%, about half of the revenue generation in 2023 was driven by our customers based in Asia.

At EUR 131.7 million (2022: EUR 84.6 million), the net result for the year was significantly higher than in the previous year. The following factors contributed to this development:

At 52%, the cost of materials ratio (cost of materials in relation to total output) was increased (2022: 50 %). This is due to relatively higher expenses for purchased services and the product mix.

The annual average number of employees at AIXTRON SE rose from 542 in the previous year to 709 in the fiscal year 2023. As result of the increased number of employees and variable remuneration components, personnel expenses increased from EUR 65.3 million in the previous year to EUR 85.7 million in fiscal year 2023.

Due to the increase in capital expenditures, depreciation and amortization increased by EUR 2.1 million from EUR 6.5 million in 2022 to EUR 8.6 million in 2023.

Other operating expenses were higher at EUR 103.0 million compared to EUR 88.6 million in fiscal year 2022. The main drivers were increased variable expenses for shipped systems and increased development costs.

In comparison to 2022, other operating income decreased from EUR 15.2 million to EUR

13.4 million in the 2023 fiscal year. This is mainly due to lower income from foreign currency translation and exchange rate gains.

In addition, a result from investments of EUR 6.8 million (2022: EUR 5.3 million) was generated in fiscal year 2023. As in previous years, the result from investments in the fiscal year consists exclusively of dividend payments from subsidiaries.

Net interest income totaled EUR 4.4 million in fiscal year 2023 compared to EUR -1.0 million in 2022. This is mainly attributable to expenses from the fair value accounting of fund investments.

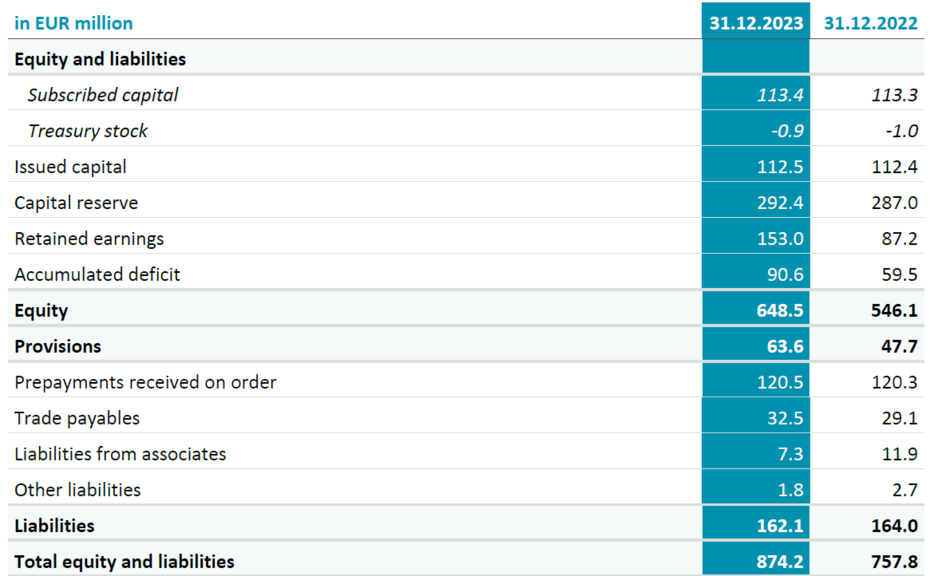

The net profit of AIXTRON SE amounted to EUR 131.7 million. An amount of EUR 65.8 million was transferred to retained earnings. Combined with the carried forward profit from the previous year in the amount of EUR 59.5 million and the dividend payment in May 2023 in the amount of EUR 34.8 million, this results in a new accumulated profit of EUR 90.6 million as of December 31, 2023 (December 31, 2022: EUR 59.5 million). The Executive Board and Supervisory Board will propose to the Annual General Meeting that a dividend of EUR 0.40 per dividend-entitled share (2022: EUR 0.31) be paid for the financial year 2023.

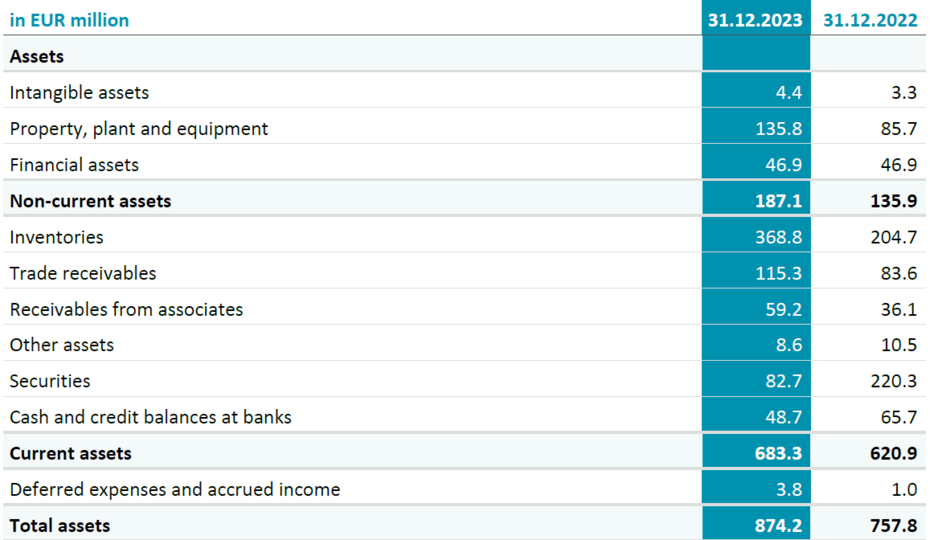

With EUR 874.2 million, total assets at the end of 2023 were about 15% higher than the previous year’s figure (2022: EUR 757.8 million). This was due the positive net result for the year.

At 51%, about half of the revenue generation in 2023 was driven by our customers based in Asia.

At EUR 131.7 million (2022: EUR 84.6 million), the net result for the year was significantly higher than in the previous year. The following factors contributed to this development:

At 52%, the cost of materials ratio (cost of materials in relation to total output) was increased (2022: 50 %). This is due to relatively higher expenses for purchased services and the product mix.

The annual average number of employees at AIXTRON SE rose from 542 in the previous year to 709 in the fiscal year 2023. As result of the increased number of employees and variable remuneration components, personnel expenses increased from EUR 65.3 million in the previous year to EUR 85.7 million in fiscal year 2023.

Due to the increase in capital expenditures, depreciation and amortization increased by EUR 2.1 million from EUR 6.5 million in 2022 to EUR 8.6 million in 2023.

Other operating expenses were higher at EUR 103.0 million compared to EUR 88.6 million in fiscal year 2022. The main drivers were increased variable expenses for shipped systems and increased development costs.

In comparison to 2022, other operating income decreased from EUR 15.2 million to EUR

13.4 million in the 2023 fiscal year. This is mainly due to lower income from foreign currency translation and exchange rate gains.

In addition, a result from investments of EUR 6.8 million (2022: EUR 5.3 million) was generated in fiscal year 2023. As in previous years, the result from investments in the fiscal year consists exclusively of dividend payments from subsidiaries.

Net interest income totaled EUR 4.4 million in fiscal year 2023 compared to EUR -1.0 million in 2022. This is mainly attributable to expenses from the fair value accounting of fund investments.

The net profit of AIXTRON SE amounted to EUR 131.7 million. An amount of EUR 65.8 million was transferred to retained earnings. Combined with the carried forward profit from the previous year in the amount of EUR 59.5 million and the dividend payment in May 2023 in the amount of EUR 34.8 million, this results in a new accumulated profit of EUR 90.6 million as of December 31, 2023 (December 31, 2022: EUR 59.5 million). The Executive Board and Supervisory Board will propose to the Annual General Meeting that a dividend of EUR 0.40 per dividend-entitled share (2022: EUR 0.31) be paid for the financial year 2023.

With EUR 874.2 million, total assets at the end of 2023 were about 15% higher than the previous year’s figure (2022: EUR 757.8 million). This was due the positive net result for the year.

Cash and cash equivalents decreased by EUR 17.0 million from EUR 65.7 million to EUR

48.7 million in the fiscal year, which results from the cash flows described below.

Cash flow from operating activities decreased from EUR 34.1 million in 2022 to EUR -75.8 million in the fiscal year 2023 mainly as a result of the high level of receivables and increased inventories as of the reporting date, which has not yet been fully reflected in cash flow.

Cash flow from investing activities amounted to EUR 88.4 million in fiscal year 2023 (2022: EUR -104.4 million) which is mainly due to the sale of funds amounting to EUR

137.6 million. In contrast, in 2023 there were cash outflows due to investments in fixed assets of EUR 60.4 million. In the previous year, the acquisition of funds in the amount of EUR 78.7 million and investments in fixed assets of EUR 30.0 million resulted in cash flow from investing activities of EUR -104.4 million.

Cash flow from financing activities amounted to EUR -29.6 million in fiscal year 2023 (2022: EUR -31.7 million). Same as in 2022, the main driver of this development was the dividend payment of EUR -34.8 million (2022: EUR -33.7 million).

There are no restrictions on access to the Company's cash and cash equivalents.

The business development of AIXTRON SE is subject to substantially the same risks and opportunities as the AIXTRON Group. AIXTRON SE generally participates in the risks of its subsidiaries in proportion to its respective ownership interest. As a result of the centralized financial management of the AIXTRON Group, all financing transactions are conducted through AIXTRON SE. As the parent company of the AIXTRON Group, AIXTRON SE is integrated into the Group-wide risk management system. For further information, please refer to the Opportunities and Risks Report.

The outlook for the AIXTRON Group largely reflects the expectations of AIXTRON SE. The earnings development of AIXTRON SE should continue to be in line with that of the Group in the future, as the results of the subsidiaries are reflected in the income from investments of the Group’s parent company. Management by means of performance indicators is carried out exclusively at Group level. The comments on the expected results of operations and financial position therefore also apply to AIXTRON SE (see in the following section “Expected Developments”).

Alan Tai

Taiwan/Singapore

Christof Sommerhalter

USA

Christian Geng

Europe

Hisatoshi Hagiwara

Japan

Nam Kyu Lee

South Korea

Wei (William) Song

China

AIXTRON SE (Headquarters)

AIXTRON 24/7 Technical Support Line

AIXTRON Europe

AIXTRON Ltd (UK)

AIXTRON K.K. (Japan)

AIXTRON Korea Co., Ltd.

AIXTRON Taiwan Co., Ltd. (Main Office)

AIXTRON Inc. (USA)

Christoph Pütz

Senior Manager ESG & Sustainability

Christian Ludwig

Vice President Investor Relations & Corporate Communications

Ralf Penner

Senior IR Manager

Christian Ludwig

Vice President Investor Relations & Corporate Communications

Prof. Dr. Michael Heuken

Vice President Advanced Technologies