- / HOME

The AIXTRON share is listed in the Prime Standard of the Frankfurt Stock Exchange and is included in the two benchmark indices MDAX and TecDAX of Deutsche Börse AG. According to the index ranking of Deutsche Börse the AIXTRON share is ranked 42nd in the MDAX, which now comprises 50 stocks since the index reform in September 2021, in terms of market capitalization as of December 31, 2021 (December 2020: 57th place among 60 stocks). As the transaction volume is no longer a relevant criterion since the index reform, no ranking is calculated for it anymore. Among the 30 TecDAX members, AIXTRON’s shares ranked 17th (2020: 22nd) in terms of market capitalization for the year ended December 31, 2021.

In addition to traditional trading venues such as XETRA and the German regional stock exchanges, AIXTRON shares are also traded to a not inconsiderable extent on alternative trading platforms such as Tradegate, Quotrix and Chi-X Europe.

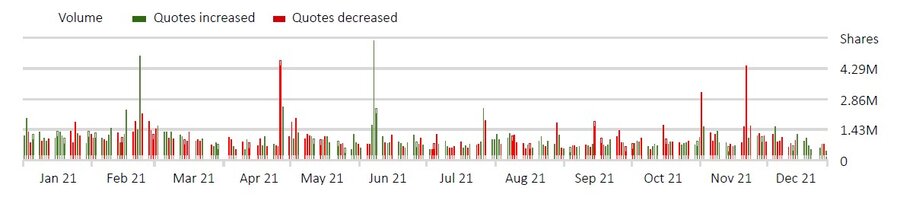

The trading year 2021 was strongly characterized by the further evolution of the COVID-19 pandemic, relief about the available vaccines and the recovery of the global economy from the strong recession of the previous year. Accordingly, the upswing in share prices on the global stock markets continued in the first half of 2021. Due to increasing concerns about inflation, interest rates and pandemic-related disruptions in supply chains, material shortages and sharply rising commodity prices, the stock market environment deteriorated in the beginning of the second half of the year, so that some of the gains were lost again by the first weeks of October. An encouraging reporting season, growing clarity about the further monetary policy course of important central banks and hopes for a strong economy in 2022 then provided new impetus for share prices. This was interrupted by the emergence of the fast spreading Omicron variant of the COVID-19 virus in November. Reports of an often less severe course of the Omicron disease and thus the prospect of a lower economic burden caused the stock markets to rise again by the end of the year. In total, despite all the uncertainties, the stock market year 2021 was quite pleasing on many stock exchanges, with some significant price gains.

Supported by the increasing return to economic normality and by fiscal policy measures, Germany’s leading index DAX and the potentially more cyclically sensitive sectors within it, initially performed much more stably than the highly valued, more interest-sensitive technology stocks. By contrast, both the enlargement of the DAX and the German Federal Parliament (Bundestag) election had only a minor impact on German equities. In the second half of the year, inflation and supply bottlenecks weighed only temporarily on share prices in Germany, too, so that an optimistic underlying mood prevailed here at the end of the year. The DAX therefore ended the year at 15,885 points, up 15.8%. Despite the implemented reforms, the DAX is still significantly dominated by cyclical stocks. In contrast, the MDAX, which also includes the AIXTRON stock, is much more heavily populated with technology stocks. The clearly different development of cyclical stocks and technology stocks was accordingly also reflected in the MDAX. Under the impression of sharply rising bond yields, which particularly affected technology stocks, a large performance gap opened up between the DAX and the MDAX until mid-May. However, with increasing clarity about the future interest rate policy, the MDAX subsequently closed this gap in the further course of the year. Particularly in the second half of the year, stock market performance was strongly driven by technology stocks. Overall, the index slightly underperformed the DAX with a gain of 14.1%. The TecDAX, almost half of which is made up of MDAX stocks, also showed a very similar development. The pure technology focus of the index caused even greater fluctuations than in the more traditional indices. Supported by the general strength of technology stocks at the end of the year, the TecDAX thus significantly outperformed the DAX and MDAX with a full-year performance of 22.0%.

The AIXTRON share benefited from a very successful business performance and outperformed the market as a whole in the generally positive market environment at the beginning of the year, but was repeatedly affected by a downward pull of volatile technology stocks. Due to the high valuation levels reached in the meantime, technology stocks in particular reacted highly sensitively to the development of the pandemic, the inflation as well as interest rate hikes becoming increasingly likely. The AIXTRON share was not immune to this development and thus lost a large part of its initial price gains.

After a slow start to the new trading year, which also included the year low of EUR 14.27 on January 7, the share benefited from strong results of the semiconductor industry as well as from positive analyst comments, which stated that massive investments in MOCVD equipment were imminent. Thus, the AIXTRON share reached a first interim high in mid-February. The full year 2020 figures and a strong outlook for 2021 also gave the share further impetus. Renewed pandemic concerns due to the increasing spread of the Delta variant temporarily impacted the share price in March. However, on April 1, it reached an interim high of EUR 19.72, already up 38% after the first quarter.

Following a consolidation phase, the results for the first quarter of 2021 caused the share to fall significantly at the end of April. Market participants pointed out that the first quarter had not been satisfactory, as the market was expecting higher results. In addition, the setback in the OLED project of the subsidiary APEVA had caused disappointment. The share fell back to EUR 15.13 by May 12 but started a slight recovery in the run-up to the annual general meeting, which decided to distribute a dividend again for the first time in several years. The share received a significant boost on June 9 from a raised guidance as a result of stronger customer demand. Within two days, the share gained more than 25% and reached a new interim high of EUR 23.37 on June 29.

After a further consolidation phase in an unsteady market environment in July, where even the expected good half-year figures did not have a large price effect, the share resumed its upward trend in August. Persistently strong chip demand underlined the need for capacity expansion and thus the positive environment also for demand of AIXTRON equipment. As a result, the share price reached its year high of EUR 26.06 on August 30, up more than 80% year-on-year. Nevertheless, the AIXTRON share was not immune to the weaker overall market and the deteriorating environment in particular for technology stocks. Investors realized some of their gains, causing the share price to fall back towards EUR 20.00.

At the beginning of the fourth quarter, the share price initially moved in a range between EUR 20 and 22. Even the once again strong quarterly figures did not provide impetus for the share price on November 4. Instead, investors were concerned about a possible slowdown of customer demand momentum in 2022, causing the share to fall by as much as 5%. In addition to the general downward trend caused by rapidly rising COVID-19 infections, concerns about inflation, and a sector rotation from technology stocks to value stocks, renewed concerns about weakening demand in AIXTRON’s core markets resulted in further significant share price declines on November 24, bringing the share price down to EUR 16.34 by mid-December. With positive news from the semiconductor industry, sentiment then changed again, resulting in a recovery of the share price to some extent by the end of the year.

The AIXTRON share ended the trading year 2021 on December 30 with a gain of 25% at a price of EUR 17.87, corresponding to a market capitalization of EUR 2,024.5 million. The benchmark indices MDAX and TecDAX increased by 14.1% from 30,796 points to 35,123 points and by 22.0% from 3,213 points to 3,920 points, respectively, in the course of 2021.

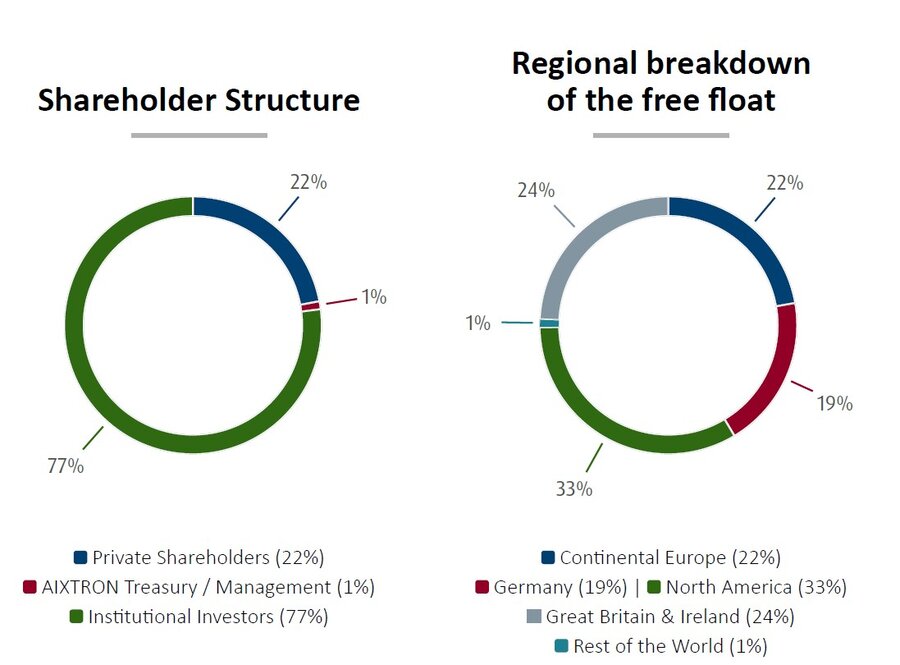

As of December 31, 2021, approximately 22% of AIXTRON shares were held by private individuals (2020: 20%), most of whom are domiciled in Germany. Approximately 77% of AIXTRON’s outstanding shares were held by institutional investors (2020: 79%). The majority of institutional investors was located in North America (33%), followed by United Kingdom and Ireland (24%) as well as Germany (19%). The remaining investors came from other parts of Europe and the world. According to voting rights notifications received by the end of 2021, Société Générale was our largest shareholder, holding more than 5% of AIXTRON shares, followed by T. Rowe Price International, Artisan Partners, Invesco, and Citigroup, each holding 5% of AIXTRON shares in their funds. 99% of the shares were in free float as defined by Deutsche Börse and approximately 1% of AIXTRON’s shares were held by the Company.

According to the voting rights notifications and public disclosures pursuant to Section 33 para. 1 WpHG, the following institutional investors held shares of more than 3% in AIXTRON SE at the end of 2021:

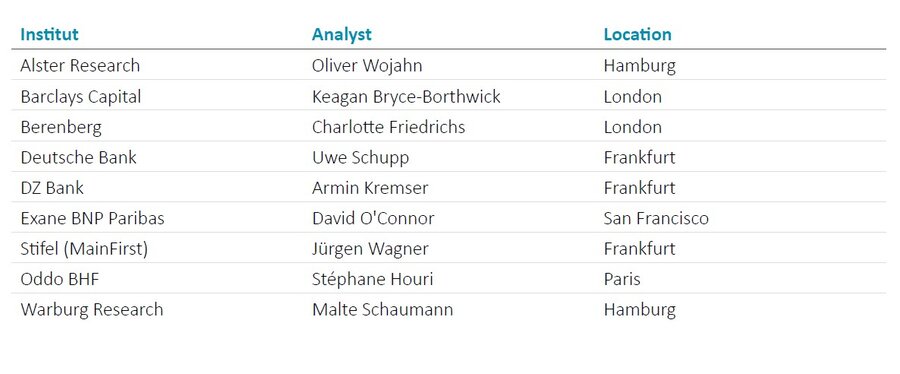

During fiscal year 2021, a total of twelve international banks and brokerage houses (2020: eleven) published regularly equity research reports on AIXTRON and the development of the semiconductor industry. Liberum and Independent Research stopped analyzing the AIXTRON share last year. Morgan Stanley initiated coverage of AIXTRON in December 2021, however, discontinued coverage again with the departure of the key analyst in February 2022. Of the ten financial analysts covering our shares at year-end 2021, six issued a buy recommendation, another three recommended holding the AIXTRON share, and one analyst rated the stock a sell. The average target price at the end of December 2021 was EUR 23.55 (2020: EUR 12.52).

AIXTRON shares are currently being monitored by the following financial analysts:

Transparency and openness in a continuous dialogue with our shareholders and capital market participants are our claim. Our investor relations work is aimed at strengthening confidence in our shares in the long term and achieving a fair valuation on the capital market. To this end, we provide our shareholders and the capital market with accurate, timely and relevant information about the AIXTRON Group’s business and our market environment. In addition, AIXTRON is committed to complying with the principles of good corporate governance.

In individual or group meetings at investor roadshows and conferences our management and investor relations team answered questions from national and international investors and financial analysts on the AIXTRON Group’s business strategy and development as well as industry and market trends. Due to the ongoing COVID-19 pandemic, the majority of roadshows and conferences in 2021 were again held exclusively virtually or in hybrid form.

The ongoing pandemic-related shift of investor relations activities to virtual platforms did not affect AIXTRON's intensively cultivated dialogue with the international financial community. In fact, even more virtual investor and analyst meetings were held in 2021 than in the previous year. The AIXTRON Executive Board and Investor Relations team communicated with a total of over 530 financial market participants worldwide in fiscal year 2021. More than 250 investor and analyst meetings took place in the form of video or telephone conferences, telephone calls, as well as occasional physical meetings.

Due to the continuing contact restrictions in 2021 to counter the COVID-19 pandemic, the General Meeting of AIXTRON SE was again held in purely virtual form on May 19, 2021. The Annual General Meeting, which was streamed completely live on the internet for shareholders, was followed online by more than 500 shareholders and interested persons. 63% of the share capital was represented. On this occasion, the Executive Board provided a comprehensive overview of the results for the 2020 financial year, the first quarter of 2021, and the Group's technologies, and answered in detail the shareholders' questions submitted in the run-up to the Annual General Meeting.

Alan Tai

Taiwan/Singapore

Christof Sommerhalter

USA

Christian Geng

Europe

Hisatoshi Hagiwara

Japan

Nam Kyu Lee

South Korea

Wei (William) Song

China

AIXTRON SE (Headquarters)

AIXTRON 24/7 Technical Support Line

AIXTRON Europe

AIXTRON Ltd (UK)

AIXTRON K.K. (Japan)

AIXTRON Korea Co., Ltd.

AIXTRON Taiwan Co., Ltd. (Main Office)

AIXTRON Inc. (USA)

Christoph Pütz

Senior Manager ESG & Sustainability

Christian Ludwig

Vice President Investor Relations & Corporate Communications

Ralf Penner

Senior IR Manager

Christian Ludwig

Vice President Investor Relations & Corporate Communications

Prof. Dr. Michael Heuken

Vice President Advanced Technologies